Forex trading, a global phenomenon, has seen a surge in the number of brokers offering their services to traders worldwide. Among them, XM Forex Broker stands out as a leading name in the industry. But what makes XM a preferred choice for traders? This comprehensive review delves deep into the offerings of XM Forex Broker, unraveling its services, features, and why it’s a go-to platform for both novice and seasoned traders.

History and Regulatory Compliance

XM, founded in 2009, has rapidly expanded its footprint in the Forex market, establishing itself as a prominent player. The broker takes regulatory compliance seriously, maintaining licenses from several top-tier authorities. This commitment ensures that traders engage with a platform that upholds high standards of security and operational integrity. XM’s dedication to maintaining a transparent and secure trading environment builds trust and reassures clients that their interests receive protection at all levels of operation.

Platforms and Tools Offered

XM offers an impressive suite of platforms and tools designed to cater to the diverse needs of traders. Each platform comes with unique features that enhance the trading experience:

XM MetaTrader 4

A favorite among traders, XM MetaTrader 4 provides a user-friendly interface with robust functionalities. Traders enjoy access to advanced charting tools, numerous technical indicators, and automated trading capabilities through Expert Advisors (EAs). The platform ensures that traders of all skill levels can navigate the Forex market effectively.

Relevant Article: XM MT4

XM MetaTrader 5

Building on the success of its predecessor, XM MetaTrader 5 offers additional timeframes, more technical indicators, and an enhanced scripting language for EAs. This platform suits traders looking for an edge in multi-asset trading, providing comprehensive tools for thorough market analysis.

Relevant Article: XM MT5

XM WebTrader

For those who prefer not to download or install software, XM WebTrader offers a convenient solution. This web-based platform allows traders to access their accounts and trade directly from their browsers, ensuring flexibility and accessibility. XM WebTrader mirrors the advanced functionalities of the MetaTrader platforms, ensuring a seamless trading experience.

Relevant Article: XM WebTrader

XM App

Recognizing the need for trading on the go, XM provides the XM App. This mobile application brings the comprehensive features of XM’s trading platforms to your fingertips. Traders can manage their accounts, monitor the markets, and execute trades directly from their smartphones or tablets, ensuring they never miss a trading opportunity.

Relevant Article: XM App

Account Types and Options

XM offers a diverse range of account types, each tailored to meet the specific needs and strategies of different traders. With the XM Micro Account, beginner traders can step into the trading world with confidence, trading smaller lot sizes and managing risk effectively. The XM Standard Account caters to more experienced traders, providing a broader array of trading instruments and standard lot sizes for a more expansive trading experience.

Relevant Article: XM Account Types

Traders looking for even tighter spreads and lower initial deposits can opt for the XM Ultra-Low Account, which offers an enhanced trading environment with ultra-low spreads. Lastly, the XM Shares Account is perfect for traders who wish to deal directly with global equity markets, offering direct access to stocks and the ability to trade shares with transparency and efficiency.

Each account type at XM is designed to empower traders, allowing them to select the one that best aligns with their trading style and goals.

Account Opening Process

Opening an account with XM is a streamlined and user-friendly process, designed to get traders into the market quickly and efficiently. Here are the key steps involved in the XM registration process:

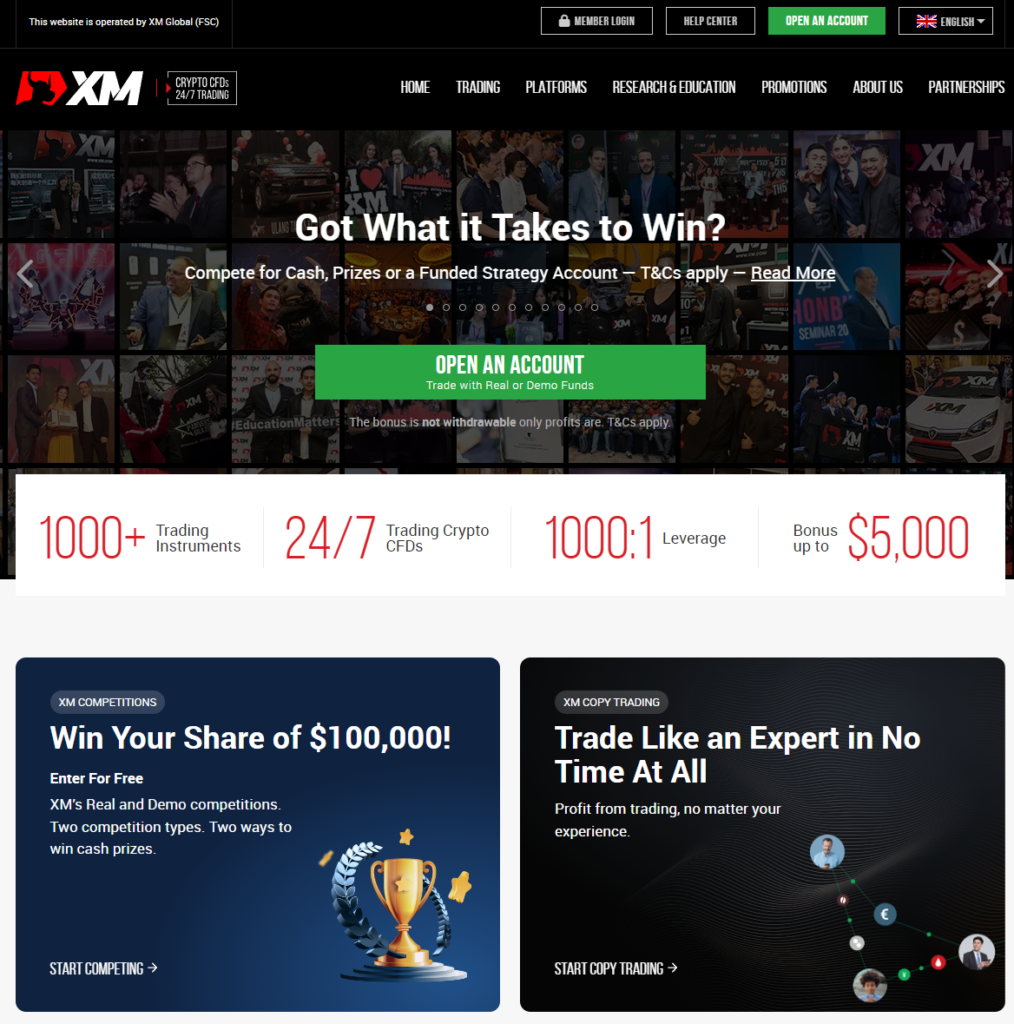

- Visit the XM Website. Start by navigating to the XM website and locating the ‘Open an Account’ button, which is usually prominently displayed on the homepage.

- Fill in Personal Details. Clicking the button will lead you to an online form. Here, you’ll need to provide your personal details, including your name, address, date of birth, and contact information, ensuring that XM can securely manage your account and comply with regulatory requirements.

Relevant Article: XM Registration

- Choose Your Account Type. XM offers different account types to suit various trading needs and strategies. Select the account type that aligns with your trading goals and experience level.

- Complete the KYC Process. To comply with regulatory standards, XM requires you to complete a Know Your Customer (KYC) process. This involves submitting identification documents, such as a passport or ID card, and proof of address, such as a utility bill or bank statement.

- Deposit Funds. Once your account is verified, you’ll need to deposit funds. XM supports a range of payment methods, including credit cards, e-wallets, and bank transfers. Choose the method that’s most convenient for you.

- Start Trading. With your account set up and funded, you’re ready to start trading. Access the trading platform of your choice, whether it’s XM MetaTrader 4, XM MetaTrader 5, XM WebTrader, or the XM App, and begin your trading journey.

Throughout the XM registration process, you can expect a high level of support and guidance from XM’s customer service team, ensuring a smooth and hassle-free start to your trading activities.

Deposits and Withdrawals

XM streamlines the process of managing your funds. Ensuring that both XM deposit and XM withdrawal procedures are straightforward and user-friendly. When making a deposit, traders can choose from a wide array of secure payment methods including credit cards, e-wallets, and bank wire transfers. Enabling quick and easy account funding. XM prides itself on processing deposits instantly in most cases, helping traders capitalize on market opportunities without delay.

Relevant Article: XM Deposits and Withdrawal

When it comes to withdrawals, XM understands the importance of timely access to funds. The platform has simplified the withdrawal process, allowing traders to retrieve their funds efficiently. With a commitment to processing withdrawal requests within 24 hours, XM ensures that traders have swift access to their earnings.

Both deposit and withdrawal processes at XM embody the broker’s dedication to providing a seamless and convenient trading experience, prioritizing security, speed, and simplicity.

Customer Support and Services

XM places high importance on delivering exceptional customer support and services. Ensuring that traders receive the assistance they need, whenever they need it. Here are the key aspects of XM’s customer support:

24/5 Availability

XM’s customer support team is available 24 hours a day, five days a week. Ensuring that traders can get help during all trading hours.

Multilingual Support

Understanding the global nature of trading, XM offers support in over 30 languages. Making it accessible to traders from different regions.

Multiple Contact Channels

Traders can reach out to the XM support team through various channels, including live chat, email, and phone. Allowing for convenient and flexible communication.

Personal Account Managers

XM provides personal account managers for traders, offering tailored guidance and support, enhancing the overall trading experience.

Educational Resources

Besides direct support, XM invests in traders’ education by providing comprehensive learning materials, webinars, and seminars. Helping traders make informed decisions.

Technical Support

For issues related to trading platforms or technical difficulties, XM’s dedicated technical support team is on standby to provide swift solutions.

Feedback and Improvement

XM values traders’ feedback and continually strives to improve its services. Ensuring that the support provided aligns with traders’ evolving needs.

XM’s commitment to superior customer support and services reflects its dedication to fostering a supportive and enriching trading environment, where traders can trade with confidence and peace of mind.

Conclusion

In conclusion, XM stands out in the Forex trading industry as a broker that deeply understands and caters to the needs of traders. From its diverse account types, including the XM Micro Account, XM Standard Account, XM Ultra-Low Account, to the XM Shares Account, the platform offers flexibility and caters to various trading styles and preferences.

The seamless processes for XM deposit and XM withdrawal ensure that traders manage their funds efficiently. Contributing to a hassle-free trading experience. Additionally, XM’s commitment to providing exceptional customer support and services, available in multiple languages and through various channels, underscores its dedication to empowering traders.

This comprehensive support structure, coupled with an array of educational resources and technical assistance, positions XM as a broker that prioritizes the success and satisfaction of its traders. Therefore, for anyone looking to navigate the Forex market, XM represents a reliable, supportive, and versatile trading partner.